Medicare Supplement Plan N - Benefits & Cost

Do you want to know my favorite thing about Medicare Supplement Plan N?

It’s not a Medicare Advantage plan.

In this article, I’ll cover the Plan N reviews that I’ve experienced as an agent since 2003. I’ve worked with thousands of clients on Plan N, Plan G, and Medicare Advantage.

I’m going to break down Plan N and give you some highlights regarding:

- Coverage benefits

- Cost

- Plan N vs. Plan G

- Plan N vs. Medicare Advantage

- Customer satisfaction reviews

- My final thoughts

Medicare Supplement Plan N Overview

Let’s jump in with an overview.

Plan N offers extensive coverage and the freedom to choose any network provider. Plan N is the second most popular Medigap plan, with over 1.5 million people enrolled.

Some of the key features of Plan N include:

- Consistent benefits year after year because Plan N is standardized – meaning that coverage is the same no matter which insurance company you choose to enroll with

- No network limitations or referrals

- Lower premiums compared to Plan G

- Offered by 95% of Medigap providers

- Your Plan N policy is guaranteed to remain in effect for life (as long as you pay your premiums on time)

Benefits of Medicare Supplement Plan N

Next up, I want to break down some of the common things that Original Medicare covers and then show you your shared cost. Let’s look at this Plan N benefit chart and then go through some of these points together.

So, first off, anything to do with your Medicare Part A cost, you have a $0 copay. That means that whatever your Original Medicare Part A deductible or copay or coinsurances, Plan N pays that for you. Your Medicare Part B is paid 100% after you pay a $257 annual deductible, and that’s for 2025.

For Part A hospice care, coinsurance, or copayment, you have a $0 copay. For skilled nursing facility care or coinsurance, $0 copay to you. It also provides an extra 365 days of hospital cost after using the Original Medicare lifetime reserve days.

Here are some out-of-pocket costs that come with Plan N (note that these do not come with Plan G):

- For the emergency room, you’re going to have a $50 copay.

- For office visits, you’re going to have a $25 copay.

- Hospitalization and skilled nursing (we’ve already kind of covered that) is a $0 copay.

- Skilled nursing facility is a $0 copay for coinsurance for up to 100 days.

- You also have a foreign travel emergency care. Beneficiaries receive 80% of coverage for emergency care outside of the United States or its territories.

- Plan N has a lifetime maximum of $50,000 for foreign travel emergency care after a $257 deductible has been satisfied.

Now, let’s jump in and talk about what’s on everyone’s mind – monthly premiums.

How Much Does Plan N Cost?

In 2025, the average monthly cost for Plan N will be between $105 and $175. However, the monthly premium for Plan N can vary depending on location, gender, and tobacco use.

I recommend considering these factors and comparing rates so you can find the most affordable and suitable Plan N coverage for your needs and budget.

This chart gives you an idea of Plan N premiums from various Medigap providers in several states:

| Medigap Provider | Alabama | Georgia | Texas | Florida | Pennsylvania |

| Cigna | $109.99 | $119.58 | $115.01 | $141.29 | $100.65 |

| ACE | $97.33 | $116.25 | $98.92 | $161.25 | $103.75 |

| Mutual of Omaha | $110.52 | $129.49 | $120.50 | $165.70 | $120.59 |

| Aflac | $115.33 | $134.70 | $128.27 | $166.02 | $110.47 |

| Allstate | $110.17 | $119.61 | $92.75 | $167.31 | $107.76 |

| Aetna | $111.87 | $130.20 | $151.27 | $172.35 | $119.29 |

| Plan N sample quotes are for a 65 y/o nonsmoking male. |

|||||

What Does Plan N Not Cover?

As previously mentioned, Plan N does not cover your Part B deductible, which again in 2025 is $257 per calendar year, and it does not cover Part B excess charges – whereas Plan G does.

Plan N does not cover pharmacy or RX benefits like all Medicare Supplement plans. You would be required to pick up a secondary prescription drug plan.

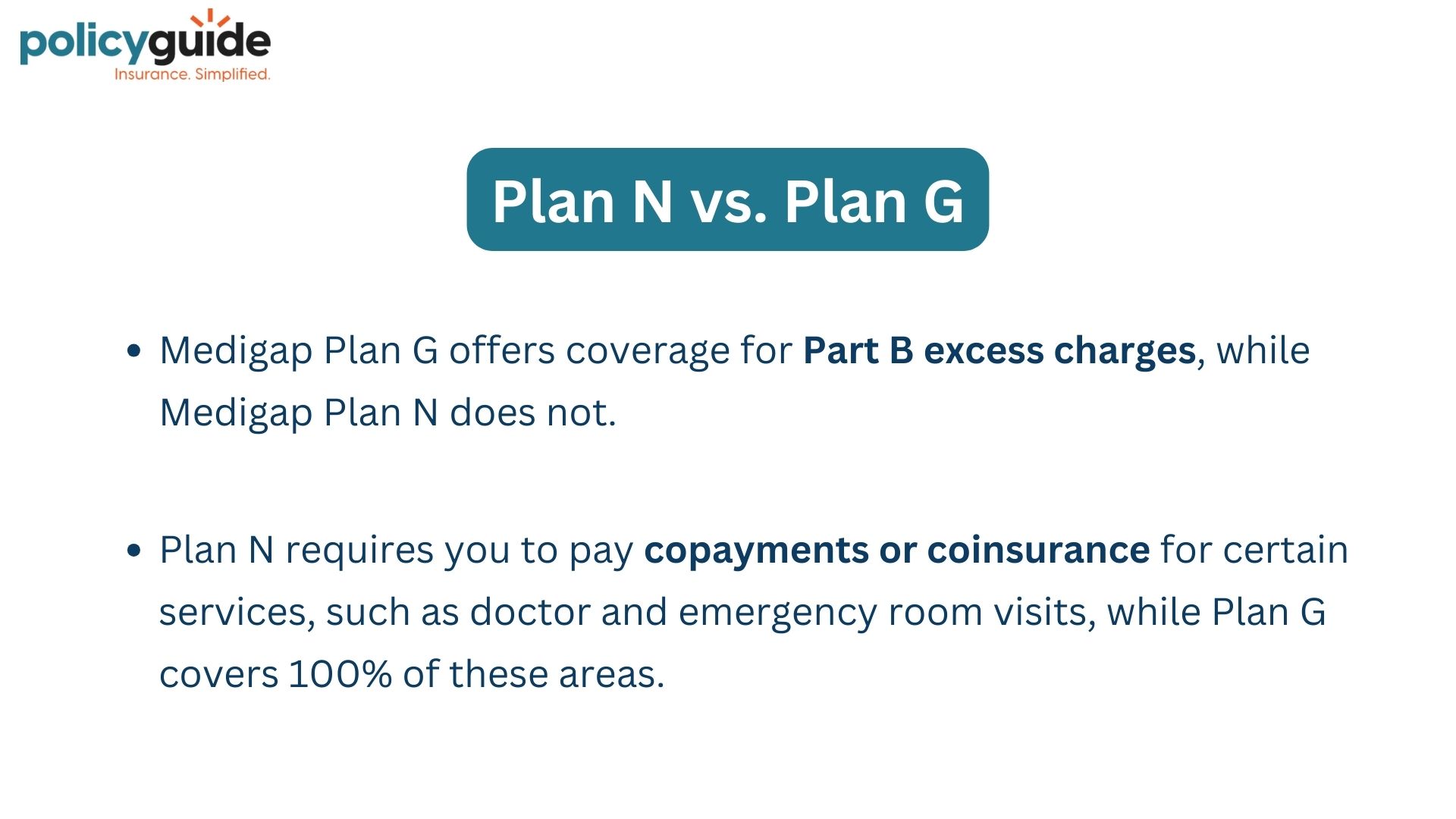

Plan N vs. Plan G

How does Plan N compare to Plan G?

Medigap Plan G offers coverage for Part B excess charges, while Plan N does not. Plan N requires you to pay copays or coinsurance for certain services, such as doctors and emergency rooms, while Plan G covers 100% of these areas.

-

Excess Charges

Okay, let me give you another scenario on the excess charges.

- Let’s say you go to a provider. They can bill up to 15% over the Original Medicare amount. Plan G will pay for that. Plan N will not.

- Plan N will have copays for doctor visits and emergency rooms – which to me is not that big of a deal because when you opt for Plan N, having those copays actually makes your monthly premium just a little bit less.

It’s imperative to compare the cost of Plan N next to Plan G just to ensure that the savings on Plan N are enough to take on those copays.

If the two are so close in price, you might as well pay a little bit higher monthly premium to have Plan G pay those office visits and emergency room copays for you because, again, when we run the numbers for clients, there’s just not a big disparity between the two.

So I would say opt for Plan G – leave the confusion and the claims process out with the copays on the office visits and ER.

Which Medigap Companies Offer the Best Medicare Plan N Rates?

When choosing a Medicare Supplement (Medigap) Plan N, it’s essential to compare monthly premiums and additional policy options. Below is a breakdown of top Medigap providers offering Plan N for a 65-year-old female in Dallas County, Texas, Lake County, Illinois, Westmoreland County, Pennsylvania, and Ocean City, New Jersey.

Top Medigap Plan N Companies

1. Cigna

- Texas Premium: $115.01

- Illinois Premium: $104.21

- Pennsylvania Premium: $100.65

- New Jersey Premium: $114.65

- Household Discount: Available (varies by state)

- Additional Policies: Dental, vision, and hearing policies available for an extra premium.

Overview: Cigna is the most affordable option in Pennsylvania and Illinois, with a competitive rate in New Jersey. The Texas premium is slightly higher.

2. ACE Property & Casualty Insurance Company (Owned by Chubb)

- Texas Premium: $98.92

- Illinois Premium: $105.25

- Pennsylvania Premium: $103.75

- New Jersey Premium: $133.00

- Household Discount: 7%

- Additional Policies: No dental, vision, or hearing policies available

Overview: ACE is owned by Chubb, an A++-rated insurance company known for its financial strength. However, ACE is relatively new to the Medicare Supplement market, so its longevity is not the same as companies like Mutual of Omaha or Aetna.

Ace focuses on offering the lowest-cost Plan N in as many states as possible without additional benefits.

3. Mutual of Omaha (Omaha Insurance Company in Illinois and United of Omaha in Pennsylvania)

- Texas Premium: $120.50

- Illinois Premium: $111.35

- Pennsylvania Premium (United of Omaha): $120.59

- New Jersey Premium: $138.46

- Household Discount: Available (varies by state)

- Additional Policies: Dental, vision, and hearing policies available for an extra premium

Overview: Mutual of Omaha has been in the Medicare Supplement space the longest and has over one million members – the highest of any company listed in this post.

While its premiums are higher than some competitors, it has a long-standing reputation and strong customer base.

4. Humana Insurance Company

- Texas Premium: $142.27

- Illinois Premium: $140.41

- Pennsylvania Premium: $133.83

- New Jersey Premium: $156.81

- Household Discount: Varies by state

- Additional Policies: Dental, vision, and hearing policies available for an extra premium

Overview: Humana has been in the Medicare space for many years, primarily focusing on Medicare Advantage. Historically, their Medicare Supplement rates have not been competitive.

However, as of recently, Humana has restructured its Medicare Supplement business, and they are showing more promising competitive rates than in past years. This shift may make them a stronger contender for those comparing Plan N options.

5. Allstate

- Texas Premium: Not listed

- Illinois Premium: $127.58

- Pennsylvania Premium: $107.76

- New Jersey Premium: $138.38

- Household Discount: Available

- Additional Policies: Dental, vision, and hearing policies available for an extra premium

Overview: Allstate is showing to be competitive in the Medicare Supplement market, but they are also new to this space, and longevity is uncertain. Their premiums vary widely by state.

6. Aflac

- Texas Premium: $128.27

- Illinois Premium: $133.05

- Pennsylvania Premium: $110.47

- New Jersey Premium: $122.90

- Household Discount: Available

- Additional Policies: Dental and hearing policies available for an extra premium

Overview: Aflac is new to the Medicare Supplement market. However, they are no stranger to the supplemental insurance industry, having been in that space for many years.

They are still a newcomer to Medicare Supplements, so long-term stability in this market remains to be seen.

7. Aetna

- Texas Premium: $151.27

- Illinois Premium: $161.94

- Pennsylvania Premium: $119.29

- New Jersey Premium: $163.27

- Household Discount: Available

- Additional Policies: Dental, vision, and hearing policies available for an extra premium

Overview: Aetna is one of the more expensive options in Pennsylvania and New Jersey but offers separate policies for Dental, vision, and hearing.

They have been in the Medicare Supplement space much longer than newer entrants like ACE, Allstate, and Aflac.

Most Affordable Medigap Plan N Company in Each State

- Texas: ACE ($98.92)

- Illinois: Cigna ($104.21)

- Pennsylvania: Cigna ($100.65)

- New Jersey: Cigna ($114.65

Cigna is the most affordable Plan N provider in Illinois, Pennsylvania, and New Jersey, while ACE offers the lowest rate in Texas.

Keep in mind that all Medigap Plan N benefits are standardized across all companies. That means Plan N with Ace provides the exact same coverage as Plan N with Humana.

The difference comes down to who is the most competitive in your area and who offers additional perks, such as household discounts or separate dental, vision, and hearing policies if those are of interest to you.

Companies like ACE do not offer any additional benefits. Their focus is purely on being the lowest-cost Plan N provider in as many states as possible. If you’re looking for the lowest possible rate without any frills, ACE and Cigna do a great job at that.

How to Enroll in Medicare Supplement Plan N

The most common way to enroll in Medicare Supplement Plan N is by comparing plans with one of our agents at PolicyGuide. Once you’ve chosen the right plan, we’ll guide you through the enrollment process over the phone.

To complete your application, you’ll need to provide some basic information, including:

- Your name, address, and phone number

- Your Medicare claim number

- Your preferred billing method

Most people choose to have their monthly premiums automatically deducted from their checking account. This ensures that payments are made on time, reducing the risk of a lapse in coverage.

Once your application is submitted, the approval process depends on your enrollment period:

- If you are new to Medicare and in your initial enrollment period, no medical underwriting is required.

- If you are applying outside of this period, you may need to go through medical underwriting.

Most insurance companies process applications within 7 to 10 business days. Once approved, you’ll receive your policy and ID cards in the mail.

The Pros and Cons of Medicare Supplement Plan N

Medicare Supplement Plan N is a popular Medigap plan for those looking for comprehensive coverage with lower premiums than Plan G.

While every Medicare plan has its advantages and drawbacks, Plan N strikes a balance between affordability and coverage. Below, we explore the key benefits and the minor drawbacks of this plan.

Pros of Medicare Supplement Plan N

1. No Network Restrictions

Unlike Medicare Advantage plans, Plan N does not have network limitations. You can see any doctor or specialist in the U.S. who accepts Medicare without worrying about being out-of-network.

This provides unmatched flexibility, particularly for those who travel frequently or live in multiple states throughout the year.

2. No Prior Authorizations Required

One of the most frustrating aspects of Medicare Advantage plans is the need for prior authorizations for many treatments, services, and even some medications. With Plan N, there is no need to wait for insurance approval before receiving the care your doctor deems necessary. You and your healthcare provider remain in control of your treatment decisions.

3. No Plan Changes from Year to Year

Medicare Advantage plans can – and often do – change their benefits, provider networks, and drug formularies annually. This can lead to unexpected out-of-pocket costs or disruptions in care.

With Medicare Supplement Plan N, the benefits are standardized and do not change year to year, providing stability and peace of mind.

Cons of Medicare Supplement Plan N (Though They Are Minimal)

While Plan N offers outstanding benefits, it does come with a few minor costs that are worth noting:

1. Small Co-Pays for Certain Services

- Doctor Visits – A copay of up to $20 for some office visits.

- Urgent Care – Falls under the same $20 copay rule.

- Emergency Room Visits – A $50 copay applies but is waived if admitted to the hospital.

These are relatively minor out-of-pocket expenses when compared to the deductibles, copays, and coinsurance often seen with Medicare Advantage plans.

2. No Coverage for Part B Excess Charges

Plan N does not cover Part B excess charges, which means if a provider does not accept Medicare assignment, they can charge up to 15% more than the Medicare-approved amount.

However, most doctors across the country accept Medicare assignment, making this a non-issue for most beneficiaries.

Medicare Supplement Plan N offers an excellent balance of affordability and coverage, making it a strong choice for those looking to avoid Medicare Advantage restrictions.

With no network limitations, no prior authorizations, and guaranteed benefits that don’t change, it provides stability and flexibility. The minor copays and the rare possibility of excess charges are small trade-offs for the significant benefits it offers.

For those who want solid coverage without the hassle of managed care restrictions, Plan N is a great option worth considering.

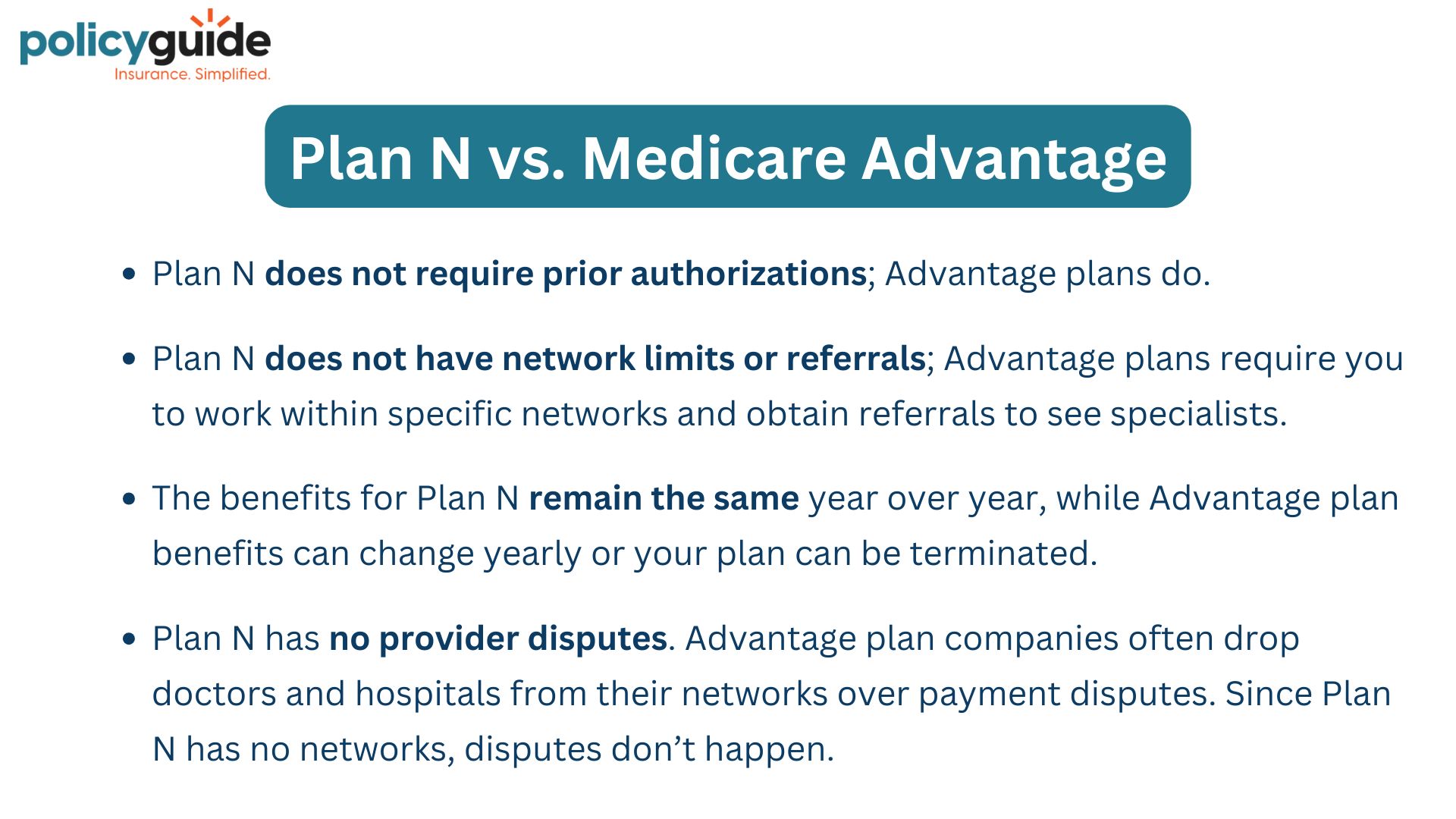

Plan N vs. Medicare Advantage

Now, probably the most important part of this article is this section—Medigap Plan N vs. a Medicare Advantage plan. I’m going to break down the core differences.

Hear me loud and clear: the biggest thing is that Plan N does not have prior authorizations. Here’s a scenario, as you’ve seen in some of my other articles and videos:

Let’s say you go in for chest pain.

They’re going to run you through all kinds of tests and procedures to figure out what’s happening.

With Medicare Advantage, those tests may require the insurance company to require prior authorization.

That means before we can proceed with this test, the insurance company has to authorize the procedure before they can do it.

So, on a Medicare Advantage plan, you could be waiting minutes, hours, or days for that prior authorization to go through. And when it’s a life-threatening issue, you don’t have minutes, hours, or days to spare.

With Medigap, there are no prior authorizations. You go in, and they’ll treat you immediately with whatever is necessary.

Again, I cannot emphasize this enough. No matter your Medigap plan, you’re not dealing with prior authorizations. However, regardless of your Medicare Advantage plan, you will deal with prior authorizations.

Another difference between the two plans, as I mentioned before, is that we are dealing with no referrals on Plan N. No networks, HMOs, PPOs, or calling providers. As long as the providers you see anywhere in the country take Original Medicare, they will take Medigap Plan N.

If you have an HMO that’s Medicare Advantage, you’ll deal with referrals. You’ll have a gatekeeper. You will have networks to deal with and work within, whether it be an HMO or PPO. Those both use networks, so that can change.

Another important difference is that with a Medigap plan – there are no benefit changes. So, on Medicare Advantage, you will see copays, premiums, coinsurance, and deductibles change each year. They most likely go up. On Plan N, whatever your benefits are, they’re locked in for life. They do not change as long as you pay that premium.

Last on the list are no CMS disputes. What is this?

- Medicare Advantage companies are actually paid by CMS or the federal government per every member they enroll. Well, that reimbursement rate can go up, and it’s very favorable to the insurance company. And then the next year, it can go down where it’s a disadvantage to the Medicare Advantage company. That’s when they may adjust your premium or benefits when they’re not getting enough from the federal government.

That reimbursement mechanism does not exist with Plan N or any Medigap plan. Original Medicare pays its part, and then you have your Medigap Plan N with its premium, and it pays its part. There’s no middle reimbursing or negotiating between the two.

Hospitals usually dispute insurance companies over reimbursement rates. It’s very common (if you just look at a lot of the news headlines) for a big provider group to dispute an insurance company. Sometimes, it results in them terminating the contract.

If you have that Medicare Advantage plan and that is your hospital, you’re now out of network.

Customer Reviews

One of the last points here is some of the strong reviews on Plan N. As I mentioned earlier, Medicare Plan N is the second-most popular Medigap plan, just behind Plan G.

A study by AHIP revealed that people are highly satisfied with their Medicare Supplement coverage. So, this isn’t a Plan N study. This is more of a general Medigap (Medicare Supplement) study.

But I found it quite fascinating when you look at the findings:

- 93% of beneficiaries were satisfied with their supplement plan.

- 83% rate their supplement coverages as excellent or good.

- 96% of beneficiaries agree that Medigap coverage allows them to see trusted doctors and specialists without worrying about out-of-pocket costs.

- Lastly, 77% of beneficiaries find the most valuable benefit to be coverage of hospital expenses, which makes perfect sense because that’s where most of the cost is incurred.

Final Thoughts

My final thoughts are this: I strongly advocate for Medicare Supplement plans.

If you can afford a Medicare Supplement, I would strongly advise you to do that for the comprehensive coverage, no network, no disputes with CMS, no referrals, and no reimbursement rates. You set it and forget it.

The only thing you need to keep track of over the years on a Medicare Supplement plan is to monitor your rate because, just like every other type of insurance (homeowners, auto, you name it), unfortunately, insurance rates don’t go down; they go up – but they’re moderate in the Medicare Supplement world. .

But that’s really the only moving part with a Medigap plan.

One of the things we do at Policy Guide is conduct annual rate checks to ensure people are still paying an affordable premium. If not, we’ll try to change companies for them and keep them on a Medicare Supplement plan.

For many reasons, Medigap Plan N is my second favorite. Plan G is my favorite because there is a little bit of additional cost and even less for you to worry about.

I hope this was informative. If there’s anything we could do to help, we’d be happy to—feel free to give us a call or email us.

Sources: AHIP Trends | AHIP Study